Understanding the concept of amortization and the schedule that professionals use to determine repayment periods can help you understand how borrowing works and help you budget for large debts like mortgages and car loans. An amortization loan requires monthly payments determined by a specific type of schedule that lenders refer to as an amortization schedule.

Some loans in the UK use an annual interest accrual period (i.e. To quickly create your own amortization schedule and see how the interest rate, payment period, and length of the loan affect the amount of interest that you pay, check out some of the amortization calculators listed below. Usually you must make a trade-off between the monthly payment and the total amount of interest. The longer you stretch out the loan, the more interest you'll end up paying in the end.

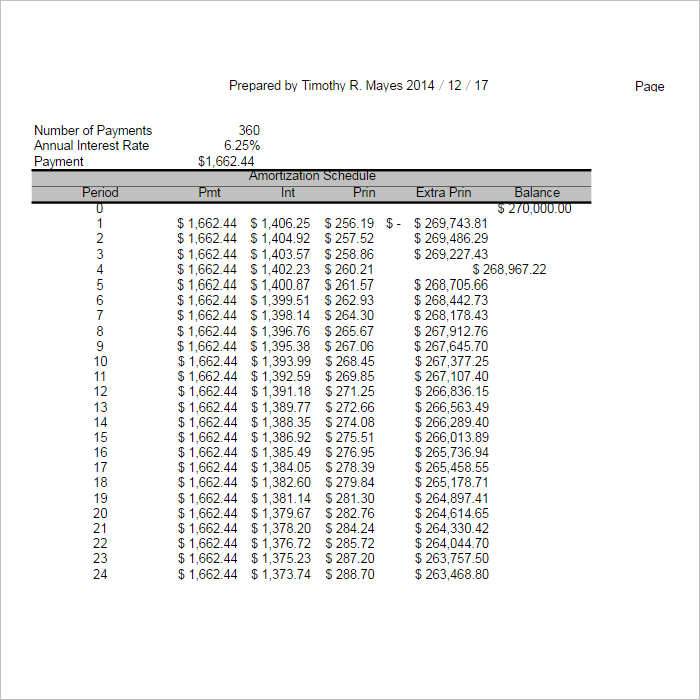

Besides considering the monthly payment, you should consider the term of the loan (the number of years required to pay it off if you make regular payments). The last payment amount may need to be adjusted (as in the table above) to account for the rounding.Īn amortization schedule normally will show you how much interest and principal you are paying each period, and usually an amortization calculator will also calculate the total interest paid over the life of the loan. The new Balance is calculated by subtracting the Principal from the previous balance. The Principal portion of the payment is calculated as Amount - Interest. The Interest portion of the payment is calculated as the rate ( r) times the previous balance, and is usually rounded to the nearest cent.

0 kommentar(er)

0 kommentar(er)